For many years, the default allocation for a large number of investors has been the “60/40 Portfolio” — an allocation so titled for its 60% portfolio weight in stocks and 40% allocation to bonds.

The conditions that made this allocation work so well, however, are no longer in place. In this article, we outline other options that should help investors to meet their financial goals without taking on large amounts of additional market or credit risk.

THE 60/40, AND A NEW APPROACH

The simplicity of this allocation was part of its strength. Over the years, its ability to mitigate volatility without a big reduction in performance made it valuable to investors who wished not to endure the full volatility of the equity markets. To use a badly worded metaphor: One could have their cake and eat it, too.

This attractive mix was possible thanks to two factors that no longer exist: Relatively high interest rates and fair valuations on stocks. A 40-year decline in inflation and interest rates created a wind at the back of both stocks and bonds, pumping up the returns of both. And now, bond yields are in the very low single digits and stock valuations are approaching all-time highs.

What is an investor to do when the wind that was once at one’s back is no longer blowing?

To make the 60/40 work in the current environment, investors need to take on different portfolio exposures and different risks. Low yielding bonds need to be replaced by, or at least supplemented with, higher yielding vehicles. Overvalued stocks need to similarly be paired with more attractively priced choices.

Put simply, investors should look at assets in the private markets. All things equal, private investment valuations should be below those of the equivalent investments in the public markets and yields commensurately higher, as compensation for the lack of trading liquidity.

But what if this lack of liquidity was a benefit, not a drawback? By definition, an asset that is priced monthly, or quarterly, will have less volatility than one whose price updates every second. That does not reduce the chance of principal loss in a private investment, of course, but it does mean that such vehicles in a portfolio could create a smoother ride for the investor.

Both affluent investors and institutions have liquidity needs that need to be carefully monitored. But those same investors likely have a portion of their portfolios that will remain invested for years or even decades to come, with no need for funds to be distributed. Investors who create a budget for illiquid investments can harvest the returns associated with that lack of trading liquidity.

PRIVATE CREDIT

The opportunity in private credit was created, in part, by the increased scrutiny of bank lending activity. Higher capital costs associated with loans to mid-sized firms effectively forced banks into to the larger end of the lending market, creating an opportunity for private lenders to fill the void.

For bond-like investments of similar credit risk, a private credit vehicle will typically post yields higher than those of the public market equivalent. A study by TIAA Global Asset Management found that private loans carried an “illiquidity premium” of 100-200 basis points (1-2%) versus syndicated loans, despite a lower default rate.

Middle market lending has even higher interest rates than one finds in the public or large corporate market, on top of the illiquidity premium. In fact, it is not unusual to find private lending vehicles yielding upwards of 9%. It is also important to note that private loans could be based on floating rates, reducing the interest rate risk of the instrument to the investor should rates rise.

There are many different segments of the private lending market, with varying risk and return characteristics. Investors are wise to carefully consider the characteristics of each one. The bottom line is that this segment is decent place to look for possible portfolio yield enhancement.

PRIVATE EQUITY

The catch-all term of “private equity” is used here to include private investments across a wide array of categories from private real estate to infrastructure to venture capital.

The characteristics of such investments will vary greatly, of course, but a common theme across many of them is higher cash flows to investors versus publicly traded securities. It is not unusual to see private investments with cash flow yields between 5 and 7 percent. In the public equity markets, the S&P500 has a current dividend yield of less than 1.6%.

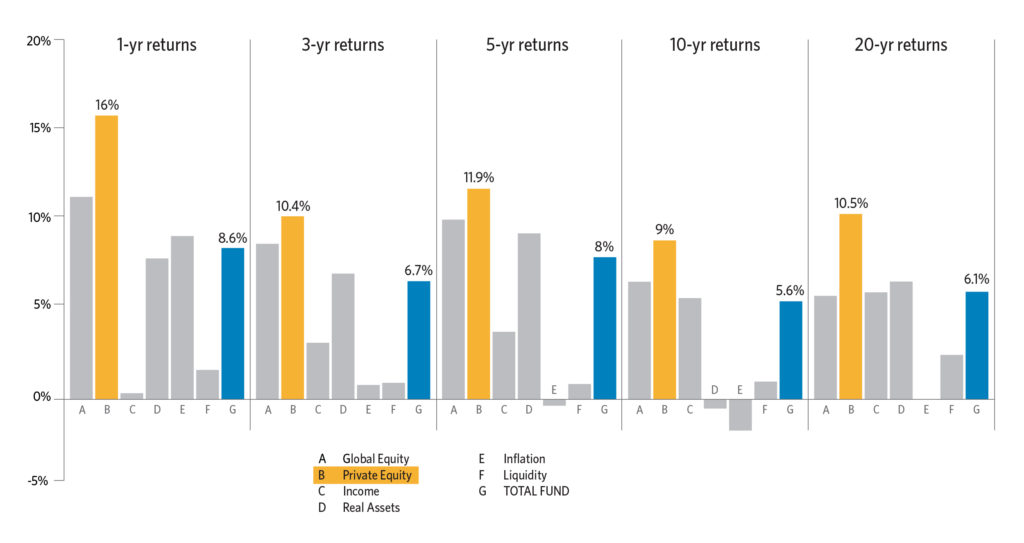

The attraction to these asset classes has been their historic return premium over listed equities. Cambridge Associates estimated this return premium to be 500bp per year over the 25 years through 2016. Similarly, retirement fund CalPERS (in the graphic below) showed a 500bp return advantage for their private equity investments over their public ones over a 20-year period.

Investors are cautioned that averages can be deceiving. The so-called “vintage year” of a private fund is among the most important factors in determining whether a particular fund does better or worse than the average. Years following recessions have typically been among the better vintages for both venture and private equity funds.

Niche-focused lower and middle market strategies often overlooked by large, mainstream investors and purveyors of mega-sized private funds. These strategies are difficult to execute at a $1bn scale. And they often rely more on micro-level strategy execution than macro-level valuation upgrades. Their “alpha”, therefore, is dependent on different drivers than those that impact the broader market, making them potentially better portfolio diversifiers.

CONCLUSIONS

Investors can draw conclusions from the relative success of other investors who have walked a similar path. Cambridge Associates tracks hundreds of institutional investors with varying allocations to alternatives. Their simple conclusion (in the chart below) was that the most successful of these investors were the ones who allocate more than 15% to alternative investments, averaging more than a 1.8% return advantage over those who allocate just 5%.

In the current environment of low interest rates and richly valued stocks, these lessons can be liberally applied to the 60/40 portfolio. Individual investors and small institutions have the added benefit of being able to execute niche alternative strategies to potentially enhance their long-term returns.