Of Expectations and Allocations

Each year, major investment firms make their assessments of the relative attractiveness of the main investment asset classes. They typically provide expected returns for the next decade. These numbers can be eye-opening when they deviate widely from historical results, while at the same time, the portfolio allocations recommended by such firms seldom reflects these expectations.

Some might refer to this as “talking out of both sides of your mouth”, but let’s be charitable and say that their recommended allocations reflect their short-term expectations. (It is also possible that low expected returns for both stocks and bonds cause them to arrive at the same allocations as before.)

That said, the logic behind the long-term return expectations of these firms is usually well supported. As with, say Vanguard, their ten-year US equity returns are based on currently elevated valuations and low dividend yields, delivering about a 5% expected return per annum through 2031.1 This is roughly half of the 10.6% average annual returns that investors have earned over the past 30 years.

If these returns turn out to be correct, then investors will need to seek other avenues for appreciation if they are to meet their asset growth objectives.

Looking Beyond Traditional Assets

Institutional investors have long sought to diversify their sources of returns, finding fertile ground in private equity, private credit, real estate, and venture capital. They may not have had lower S&P 500 return expectations in mind when they added private investments to their portfolios, but the 490bp return premium2 on private versus public equity over the past 20 years still provided ample motivation to make a shift.

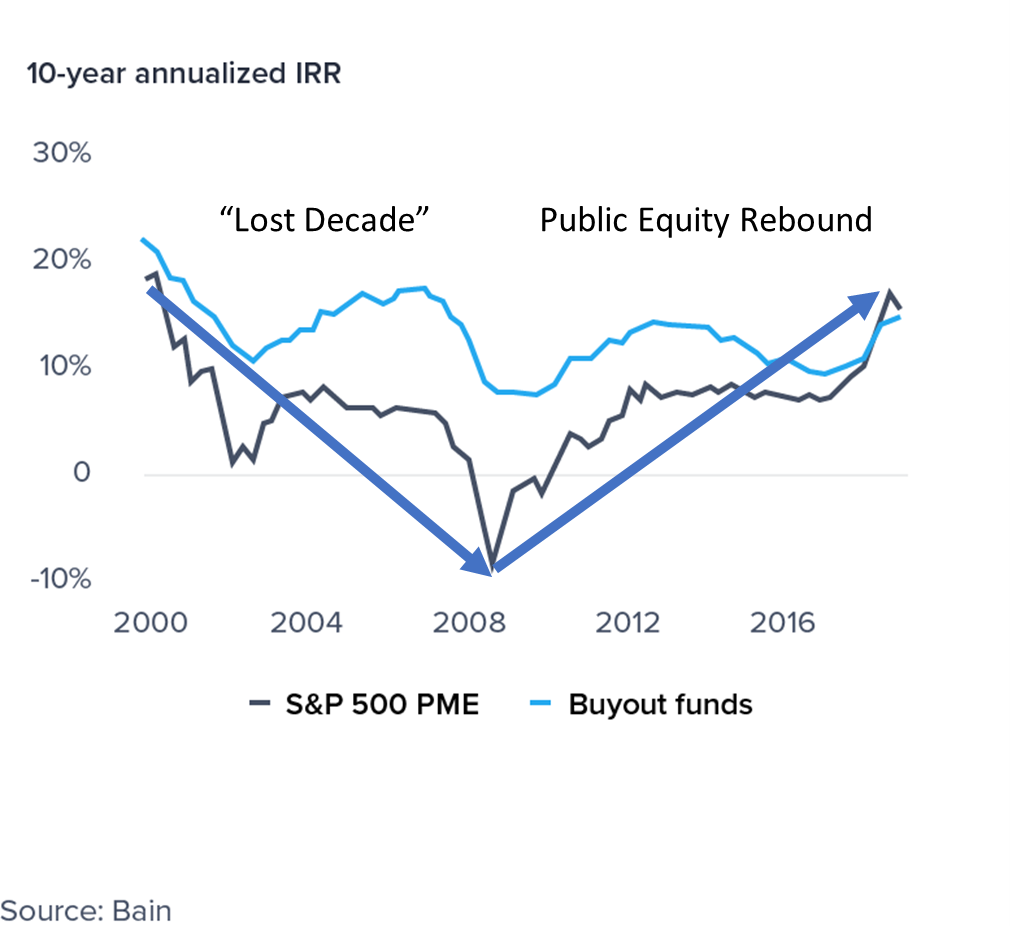

It is important to note that the 20-year record of outperformance, referenced above, was driven to some degree by the elevated valuations of public equities in the year 2000. The so-called “lost decade” in the S&P 500 was a consequence of the elevated valuations of technology firms at the start of the period — and the more defensible appraisals at the end.

How similar is that environment to today’s lofty multiples?

As the chart at the right illustrates, an analysis of ten-year returns periods from private equity versus the S&P 500 shows two things: The rebound of public equities from that lost decade, and the far greater cyclicality of public market returns versus private. The most recent leadership of public equity versus private coincides precisely with elevated valuations on public shares. It can be argued that this performance advantage could therefore be temporary, completing the 20-year cycle.

Public Markets Benefited from Liquidity

In the COVID-19 environment, accommodative monetary policy has boosted money supply. McKinsey estimates that central banks have injected $9bn into financial assets worldwide in the current environment versus only about $2bn during the 2008-09 financial crisis.3 It is widely assumed that a large share of this money has made its way into the public equity markets. This, along with a larger pool of retail investors, has resulted in elevated valuations among US public equities.

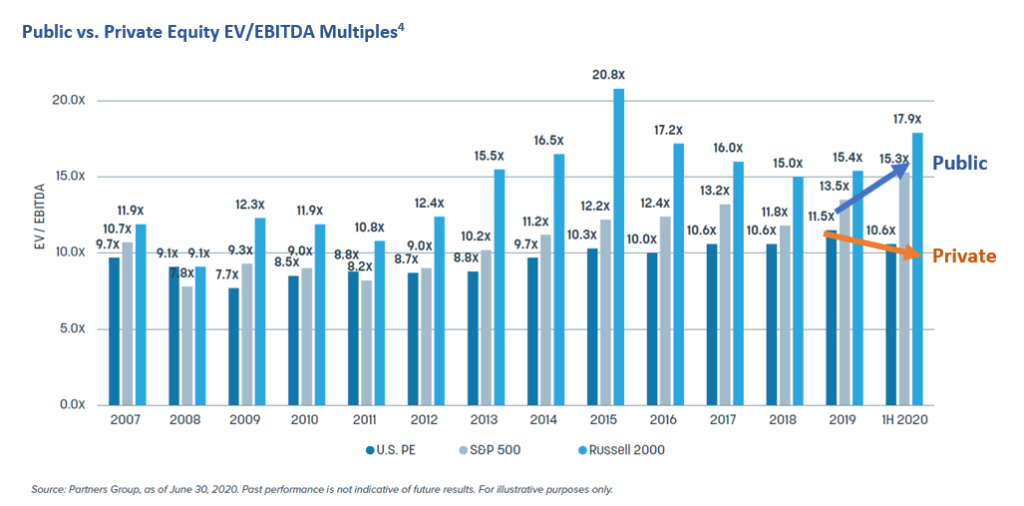

Private equity acquisition multiples have also risen modestly over time, but then fell back during the pandemic while public equities continued to climb. The presence of low borrowing costs for private deals is clearly correlated with the low interest rate effect on public equity multiples. It is much harder to argue, however, that central bank liquidity has filtered into private equity flows. More than $2.5tn of dry powder held by buyout firms has been a fixture for several years and is not a recent phenomenon.

Can Private Equity Lead Again?

Investors can surmise that large buyout firms must do increasingly larger deals. Studies also show that higher entry multiples are directly related to lower fund returns.5 Taken together, the outlook for PE is tempered by the inevitable presence of mega deals and high valuations. It then follows that the lower and middle market segments should have less difficulty placing capital and may not be burdened by elevated entry multiples.

Altera’s focus on this segment, and primarily with funds that favor lower valuation multiples, leads us to expect a wind at the back of such funds. We see such skilled private capital allocators continuing to add value for firms positioning for a founder’s exit, seeking growth capital, or desiring financial and operational resources during a difficult environment.

Relative to overpriced public equity indexes, lower and middle market private equity has the potential to both diversify and enhance investor returns over the coming decade.