Altera Investments conducts due diligence on a wide array of private equity managers and sponsors in the middle and lower market. Our objective with this research is to create vehicles that allow investors to take advantage of specific niche strategies in areas that we have identified as attractive in the current environment.

Today, we are sharing a model success story of how managers can get things right, exiting a position at three and even four times their cost in just a few years. Private funds typically have strict confidentiality guidelines, but we can share generalities that are illustrative of industry best practices and how private equity “works”.

Creating Value to Deliver a “Win”

Altera begins by targeting investments that are consistent with our view of the macro environment at the time. For example, in 2020, the US was in the latter stages of the 10+ year bull market and economic expansion, so Altera chose to err on the side of caution, selecting funds with durable strategies, less leverage and strong “value” underpinnings.

PE managers have varied approaches to their craft, but Altera focuses on funds and strategies that address lower-to-middle market companies. In our view, more durable and successful funds work in this less-traveled segment and are particularly choosy about the valuation of their acquisition targets.

As we have recently seen, it is common for a PE manager to team up with other investors (and talent) to elevate their acquired companies to a higher level of competency and scale. Their objective in doing so is clear: Together, they can exploit an opportunity that seems just out of reach.

This team of investors brings in new management and additional capital with the clear objective of accelerating and scaling what is already present. They utilize some borrowed money to acquire the position more economically, without diluting their ownership, potentially multiplying their gains if successful.

Importantly, the target company’s original ownership group needs to agree that the addition of new resources could help it achieve more that would be possible on its own. In other words, by giving up some equity, two plus two could equal five. Or perhaps ten.

When their efforts start to bear fruit with accelerated growth, the portfolio company has the capacity to satisfy a larger clientele. If that new customer is thinking strategically, it may see an advantage in keeping its competitors from doing the same. The “win” is when this customer becomes a strategic investor, deciding to take a controlling stake in the company. And the portfolio company is now much larger, so its exit valuation should be several multiples of the PE firm’s cost.

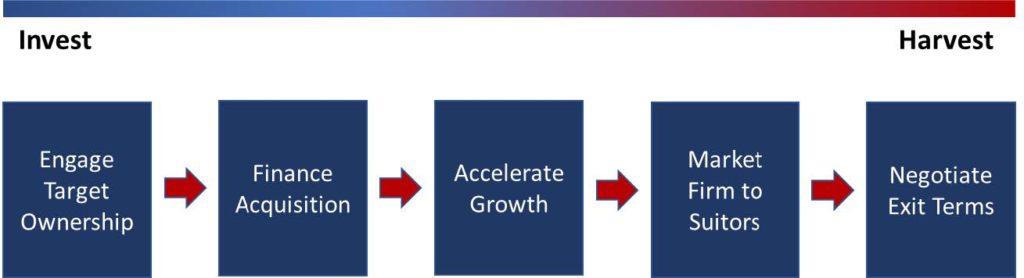

In summary, the investor team identifies an opportunity and an ownership group that is receptive to some help. They have a clear “exit” mindset from the start and build a better and larger company to take advantage of the opportunity before them.

The Investor Experience

The investor “subscribes” to a private equity fund, committing a certain dollar amount of this investment. Their decision is likely based on the fund team’s past track record, quantitative and qualitative measures of competency, and on the positioning of the fund for the current and expected environment. They are hoping that the Internal Rates of Return (IRR’s) earned by this manager’s past funds would hold true again. But they may have to wait for eight years, or more, to fully earn those returns.

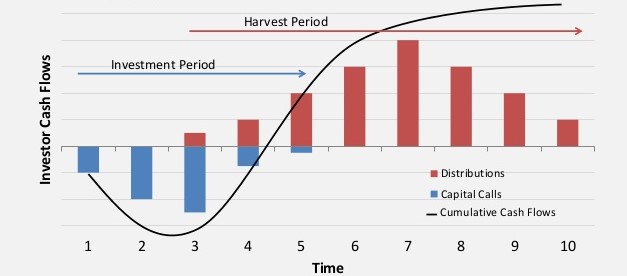

Occasionally, no money moves in the first months after this commitment (creating a bit of confusion on the part of some investors.) These early ownership months can be decidedly dull, as a fund methodically finds deals that meet their strict criteria. In fact, until cash flows accelerate from fund investments, the Net Asset Value (NAV) of the fund can decline (as shown below) in what is known as the “J-Curve”.

Periodic capital calls are evidence of the team’s activity, however. Within the first few years, a fund will have amassed stakes in a handful of companies, calling a significant portion of the capital.

Between the time of acquisition and the ultimate exit, PE managers will have to deal with a variety of issues, both general and those unique to their companies. In 2020, for instance, PE managers had “damage control” responsibilities, supporting portfolio companies, and making sure that the firms were taking the necessary steps to survive in the new COVID-19 environment.

In Altera’s case, choosing a private equity managers with an emphasis on resilient companies acquired with little debt was prescient. It was intended as a defense against a more difficult environment – not a pandemic. But this approach served its purpose in this new setting.

Winners and Losers

Private equity funds likely have anywhere from ten to thirty positions, and any one of them can produce returns of several hundred percent (typically referred to as “Multiples of Invested Capital”.) But, by the same token, companies can fail or deteriorate for any number of reasons. It is not unusual to look at the list of positions held by a PE fund and see some that are held at 0.2x their original cost. Diversification, therefore, is key.

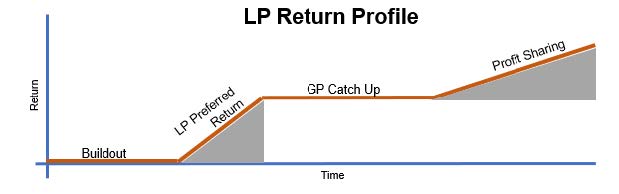

Over time, fund managers have a deep incentive to build value: They get a portion of the profits. Part of any robust analysis is to scrutinize the fund’s the fee structure to make sure that incentives are well aligned between the manager and the Limited Partners. In fact, this is a high point of working with many of Altera’s chosen managers. Their fee structures need to be “LP friendly”, with a relatively high bar to be crossed before they earn any incentive compensation.

Investors receive distributions over the life of the fund as exits are consummated. But by the end of the fund’s target life span (7 – 10 years), some positions will likely still remain. It may take a while longer for the managers to find buyers for these remaining positions, but in all likelihood, these are a small part of the total value of the fund. And like the funds in question here today, investors should have earned the bulk of their returns on the other positions that have previously been sold.

In the end, we are hopeful that these General Partners of our funds get very rich. Because that means our investors will have built their wealth, too.